The evolution of computing, beginning in the 1950s, has traversed the mainframe era, the personal computing era, and currently, we find ourselves approaching the twilight of the smartphone era. While IoT has been defined to some extent, it has yet to witness widespread implementation, widespread adoption, and the consequential impact on productivity.

In summary, computers have enabled the execution of index investing and quantitative strategies, resulting in reduced costs for investors and a decline in profitability for the asset management industry, particularly for traditional fundamental asset managers who have seen limited benefits beyond email and Excel.

Moreover, this technological advancement has fueled the exponential growth of global information, often referred to as “Big Data,” which traditional fundamental asset managers struggle to harness.

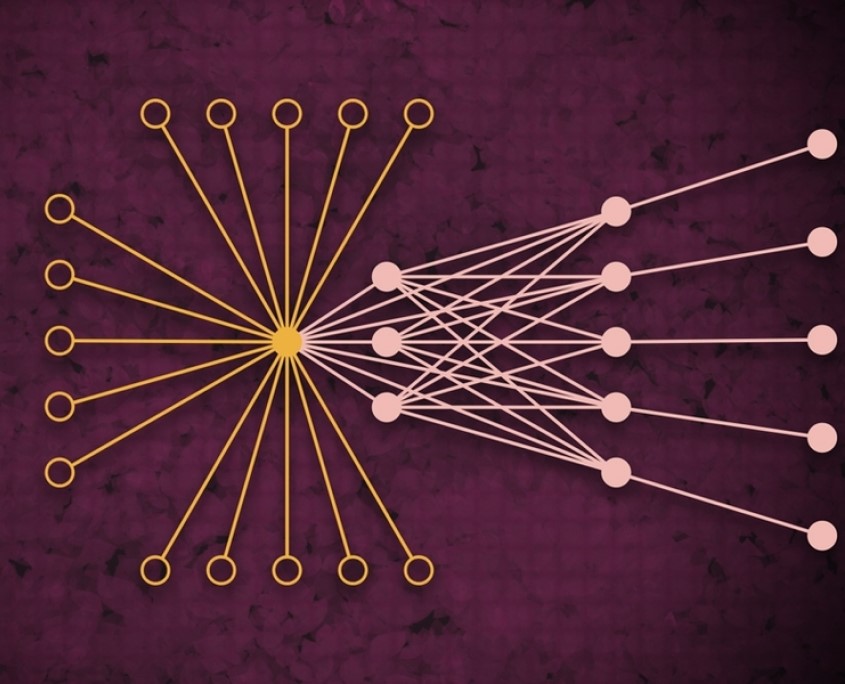

We remain committed to fundamental investing, but unlike many others in the market, we have embraced a fully digital approach. Our operations encompass large-scale data ingestion, a proprietary data repository, automated forecasting, portfolio construction, risk management, and client reporting.

To succeed in the next generation of fundamental asset management, it’s essential to adopt a technologist’s mindset and leverage cutting-edge tools and techniques.