“The soul never thinks without a picture”

We all know the age-old expression “a picture is worth a thousand words” but let’s see if it still holds up in today’s world!

I am guessing you are most likely reading this on a smartphone phone screen. Apple’s iPhone 13 has a resolution of 2532×1170 pixels, giving it a total pixel count of just under 3 million (2,962,440 to be exact). As each pixel is 1024 bits, that’s just over 3 billion bits (again 3,033,538,560 if you are counting) to show you what’s on your smartphone screen!

So, how many words is that worth? Steve Wolfram (through wolframalpha.com) will tell you that the average word in English is 5.1 characters long. As each character is 8 bits, the average word takes 40.8 bits. So, with over 3 billion bits for a screen, you are looking at an equivalent of over 74 million words (74,351,435 for those of you still with me). Certainly, there is spacing between the lines (so half that) and a bit of other “wasted valuable screen real estate” but even if you half that number one or a few more times, the number is still much larger than 1000 words. Let’s consider out of scope the discussion about how many readers will actually focus for more than a few lines.

Thus, an image, or our logo in this particular case, should speak to customers way more than a thousand words! It aims to communicate to current and potential customers, as well as employees (in short, all stakeholders) what the company does, what it stands for and what it intends to achieve. Moreover, a well-designed company logo should communicate all the above on its own, without company by-lines or any additional text.

Simply put, Quantworth and its logo stand for growth delivered by applying new methods to a classic process. The logo is a representation of growth, viewed from different dimensions. As such, it may fall slightly short of the above mentioned gold standard of speaking well on its own but hopefully what follows will help close that gap.

The principle concept behind the logo is growth. As Quantworth “quantifies how much companies are worth”, we deliver that growth by buying undervalued and selling overvalued companies. This is fundamental investing 101.

The basic representation of growth is usually shown with an upward-sloping line or bar chart. The image below was our starting point, a simple and elegant depiction of growth. It also pays homage to a logo of a company founded by a party we have been fortunate to be acquainted with and greatly admire but that’s a story for another time.

We deliver this growth following a fundamental bottom-up process but this process is delivered by leveraging a variety of modern approaches. These modern approaches allow for repeatability, transparency and scalability, enabling us to consider multiple dimensions of an investment opportunity.

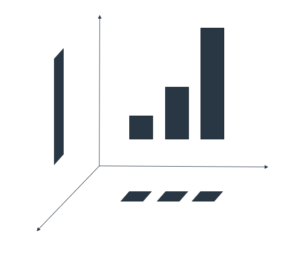

We represent our growth with an even simpler bar chart, with lines doubling in each subsequent time period. Viewed in 3D, it looks like this:

This chart can then be viewed from three different dimensions: front, top and right. The front view is still the very familiar representation of an upward-sloping bar chart:

Top view, however, looks as no growth, a flatline return, perhaps three coupon payments of a bond, or an annuity:

The right view looks like a one-off payment (call it a lump sum, a one-trick pony), hiding all the detail away from perspective:

Putting it all together in the on a x, y, z axis produces the following projections on the respective planes:

Now, if you were to stand a cube on a diagonal so that it is perpendicular to our viewing plane – you will see the outline of a hexagon. Overlaying the three projections from above on the relevant planes allows you to come up with Quantworth’s logo:

It is an image that to us speaks about multiple viewpoints being brought together to generate one complete picture. As investors, we look for attractive investment opportunities through a fundamental bottom-up process.

We accomplish this goal by leveraging modern tools, cutting-edge technology hosted securely in the cloud.